How To Set Up A Corporation In Illinois

Do It Yourself

Sign up for a complimentary account and use our online tools to outset your Illinois corporation today. Includes Illinois incorporation and maintenance walkthrough and company certificate creation. All for free—merely pay land fees.

$ 0 Total

Go Monthly

Skip the land fees! Get an Illinois corporation and the best of our services today. Includes EIN, hassle-free maintenance, business accost & mail forwarding, Privacy by Default®, local Corporate Guide® service, and everything you demand to operate at full capacity.

$ fifty / Month

Pay in Full

Get Illinois corporation , business address & free mail forwarding, free 60-day Telephone Service trial, Privacy by Default®, lifetime support from local Corporate Guides® and a yr of registered agent servic e .

$ 405 Total

Rated four.five / v stars by 317 clients on Google

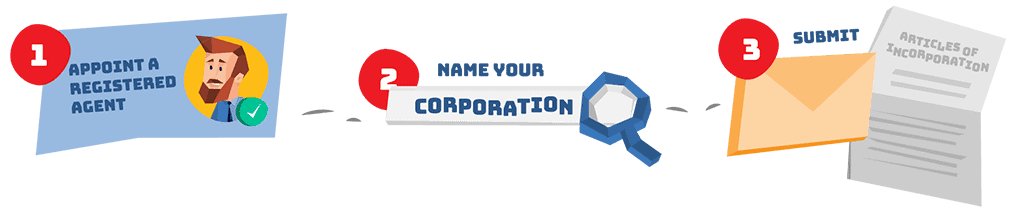

To showtime a corporation in Illinois, you lot'll need to do 3 things: appoint a registered agent, cull a name for your business, and file Articles of Incorporation with the Department of Business Services. You can file this document online or past mail. The articles toll a minimum of $175 to file. Once filed with the state, this document formally creates your Illinois corporation.

i

Appoint a Registered Agent

Per § 805 ILCS v/5.05 (2019), every Illinois corporation must appoint a registered agent. You don't demand to rent a registered amanuensis, just if you lot do, make sure your registered agent will listing their accost on your articles wherever possible to ensure maximum privacy.

2

Name Your Corporation

If you're starting a new business, yous probably already know what you want to name your corporation. But you'll need to know if your preferred name is bachelor. To observe out, visit the Illinois Department of Business Services database and browse until you find the perfect name for your corporation.

iii

Submit Illinois Manufactures of Incorporation

In one case you know who your registered agent will be and what your corporation name is, yous're ready to file your Illinois Articles of Incorporation. Follow along with our filing instructions beneath:

Learn more nearly each Articles of Incorporation requirement below. Annotation that the information y'all provide becomes role of the public record—permanently.

Ameliorate withal, skip the form entirely and hire us to incorporate your Illinois business. Nosotros provide a gratis business address to list whenever possible throughout the filing to better go on your personal address private. And for the cheapest way to starting time a business organisation? Pay just $50 out the door with our VIP monthly payment option.

1. Corporate Name

Your name must include "Corporation," "Incorporated," "Express," or an abbreviation for ane of these words. Tip: Many corporations opt to keep it simple with "Corp" or "Inc."

2. Registered Amanuensis

For your Illinois registered agent, you lot can list an individual state resident (similar someone in your Illinois corporation) or a business concern that provides registered agent service (similar Northwest). Tip: We recommend Northwest.

three. Registered Part

The registered office is the Illinois street address where your registered amanuensis will exist available during business hours to accept legal notifications for your corporation. Tip: When you hire Northwest, our address volition become hither.

4. Purpose

Your articles already list a general purpose, which is sufficient for most corporations. However, some corporations—namely professional person corporations—are required to list a specific purpose too, such every bit "practicing medicine." Tip: Just a regular business corporation? You can skip this section.

5. Authorized Shares

Listing the number of shares y'all desire to create and how many shares you advise to be issued. (You don't actually issue any shares at this time; you lot can issue shares at your organizational meeting.) You'll also need to include the "consideration" (money) to be received in exchange for the shares you plan to issue. Tip: Online filings only permit one form of shares. If you desire multiple classes of shares, y'all'll need to file a paper grade and include the rights and restrictions of each share form.

6. Directors

Y'all're not required to list the number of directors or the information for any directors or officers in your articles. But if you don't, the state will weirdly list your incorporator as your corporation's president. (This can be fixed by filing an amendment.) Tip: Don't want your incorporator listed as president? Avoid an amendment and list at least i manager. Hire u.s.a. and you lot can use our business concern address for your manager to better maintain privacy.

7. Estimated Values

This information is also optional. If y'all desire, you can provide estimates for the value of property in and out of the state, and estimates for the corporeality of gross business that will occur in and out of the state. Notation that everything in your articles becomes function of the permanent record of your Illinois corporation. Tip: If you don't actually want to calculate this out (or give your competitors easy access to your financial details correct out the gate), you're free to skip this section.

viii. Other Provisions

This is an optional section where you tin add together provisions of your ain. If y'all want to change the elapsing of your corporation (how long it lasts) or define policies, such as those for voting or transfers, you lot can exercise and then in this department. Tip: Many provisions, such as adjustments to voting rights, can be made in your bylaws instead, which are easier to modify if needed afterwards on.

9. Illinois Incorporator

Your incorporator is the person who signs and submits your Manufactures of Incorporation. Incorporators must include their proper noun and address. Your incorporator doesn't have to be a director, officeholder, or anyone in the corporation—just a legal adult you authorize to sign and submit your grade. Tip: We'll exist your incorporator when you lot hire Northwest to form your Illinois corporation.

Professionals in Illinois hire registered agent services like Northwest Registered Agent for incorporation—just why?

Logistics

Standard filing companies don't accept employees or offices in every state. But as a national registered agent, it's a requirement for the states, which is a benefit for our clients. We own our own building in Springfield, IL. We're on a first name footing with the people who work in the Section of Business concern Services. We know all the fastest filing methods, which translates to fast, professional service—without extra fees.

Privacy

As your registered agent, we listing our Springfield registered part accost on your corporation's formation documents. Why? If you're starting a business from your apartment in Chicago, do you really want your apartment accost as your business address? (Hint: the answer is no.) Nosotros'll list our accost, so you don't have to list yours. Plus, we never sell your data. We don't list your personal data on filings if we don't accept to. It'southward all standard and part of our commitment to Privacy by Default®.

Free Post Forwarding, Business Address and More

At Northwest, we practice everything a registered amanuensis should practise and more. You tin list our accost every bit your business concern address on your state filings. We include limited digital mail forwarding with registered agent service (upward to 5 pieces of regular postal service per year; $15 a medico afterward that).

Plan on accepting credit cards? We also offer a Free Credit Card Processing Consultation. Our specialists piece of work with processors to negotiate low rates and meliorate contracts for our clients.

And now, endeavor our in-house Northwest Phone Service for 60 days, costless of charge with our formation service. Get a virtual telephone number with your option of area code, make and receive calls from any device, and more than—for just $9 a month.

Local Expertise

Nosotros know the in's and out's of each state—and we employ this knowledge to help y'all when you lot demand it most. Our team of Corporate Guides® has over 200 local business concern experts. You can call or electronic mail us for answers to all your questions nearly your corporation in Illinois. Our Corporate Guides are dedicated solely to helping you with your business—non selling you services or meeting quotas.

Afterwards your Illinois Articles of Incorporation are approved, you still have a few more of import steps to take, including getting an EIN, drafting bylaws, holding your first coming together, opening a bank account, and learning nigh state reporting and tax requirements.

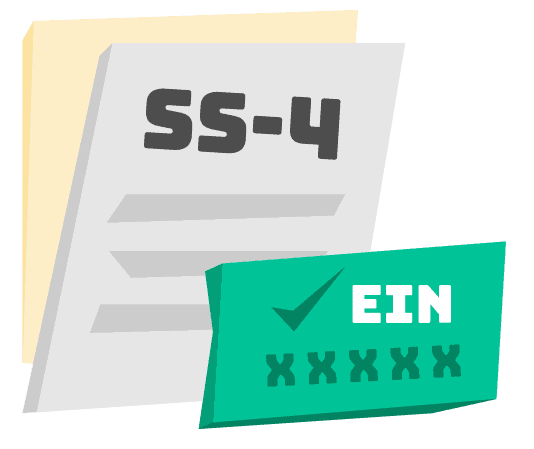

Become an EIN

Your federal employer identification number (commonly known as an EIN or FEIN) is similar to a social security number for your business organisation. The IRS assigns these numbers and uses them to hands identify individual corporations on tax filings, including federal corporate income tax returns.

Why does my Illinois corporation need an EIN?

The IRS requires corporations to become an EIN for their federal tax filings, and the Illinois Department of Revenue requires an EIN for their business registration. You may also be asked for your EIN when opening a bank account, securing a loan, or applying for local business concern permits and licenses.

How do I become an EIN for my corporation?

You can go an EIN directly from the IRS. The application is free, and well-nigh businesses tin apply online. However, if y'all don't have a social security number, y'all'll need to submit a paper application form. Can't bear to fill up out nevertheless some other application? Hire Northwest to go your EIN for you. But add on EIN service during checkout when you sign up for our incorporation service. Or choose our VIP service—an EIN is included.

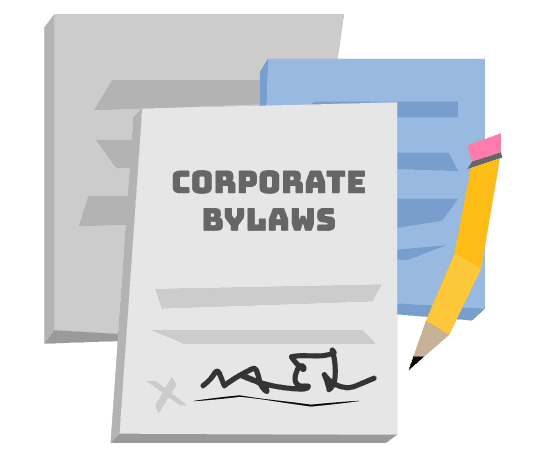

Write Corporate Bylaws

Bylaws are the internal rules you prepare for your business concern. They put into writing how decisions will exist made and who gets to make those decisions. All the major organizational processes and procedures for your corporation will go in your bylaws.

For more than on Illinois Corporate Bylaws (including our free Corporate Bylaws template), see our Illinois Corporate Bylaws resource.

Do I demand bylaws for my Illinois corporation?

Yes. Land statute §805 ILCS v/2.20 notes that bylaws shall exist adopted either by the shareholders at the first shareholder meeting or by the initial directors at the initial director meeting.

You don't accept to submit bylaws to the country though. Corporate bylaws are internal documents you lot keep with your other corporate records, such as meeting minutes and resolutions.

What should bylaws include?

Corporate bylaws cover bones policies and procedures for problems such every bit company finances and management. Bylaws should cover a range of topics, answering key questions like those below:

-

Meetings: When and where volition meetings for shareholders and directors be held? How many attendees are required to transact business? What are the procedures for voting or proxy voting? How do you phone call a special meeting? What actions can be taken without a coming together?

-

Stock: How are stock certificates issued and transferred? How is voting affected by issues such as corporate stock owners or fractional shares?

-

Directors and officers: How many directors must there be? Which officeholder positions are required? What powers do they accept? How do yous fill a vacancy or remove a director or officeholder?

-

Finances: What are the procedures for retaining profits, issuing dividends, and paying bills? Who can withdraw coin from the corporate bank account or sign checks?

-

Records: Where is the corporate book to be kept? What data will be maintained? How are requests for review or access honored? Can records or copies be kept or distributed digitally?

-

Amendments and emergencies: Who tin can amend bylaws and how? Tin can emergency bylaws be adopted in the instance of disaster?

Illinois bylaws can make other provisions as well, assuming additions are in accordance with state law. For instance, §805 ILCS v/2.10 states that Illinois bylaws can authorize or limit preemptive rights (the ability of shareholders to buy future shares earlier they become available to the public).

How do I write bylaws?

Creating bylaws can be overwhelming—where do you start? Northwest can assist. We give y'all free corporate bylaws when you lot rent us to grade your Illinois corporation. We know what kinds of topics and questions corporations need to address, and we've spent years refining and improving our forms. We offer many other free corporate forms also, including templates for resolutions and meeting minutes.

Hold an Organizational Coming together

An organizational meeting is the first official meeting of the corporation after the business is legally formed with the country. At this coming together, bylaws are adopted, officers are appointed, and any other initial concern is conducted. The starting time meeting minutes should likewise exist recorded and added to your corporate tape book.

Are there any special rules for Illinois organizational meetings?

You're required to give a minimum of three days find before holding the meeting. Attendees can, however, waive their required notice in writing. The meeting doesn't have to be held in Illinois.

Open a Corporate Bank Business relationship

Businesses that mix personal and business organisation finances together chance losing their liability protections, so your corporation will demand its ain bank business relationship. In addition, a corporate bank account is essential for hands accepting payments, paying bills and property funds.

How do I open a bank account for my Illinois corporation?

To open a corporate bank business relationship in Illinois, you'll need to bring the post-obit with you to the bank:

-

A copy of the Illinois corporation's Manufactures of Incorporation

-

The corporation'south bylaws

-

The corporation's EIN

If your bylaws don't specifically assign the power to open up a banking company account, yous may likewise want to bring a corporate resolution to open a banking concern account. The resolution would land that the person going to the bank is authorized past the business to open the business relationship in the proper name of the corporation. At Northwest, we provide free corporate banking concern resolutions, along with many other free corporate forms, to aid yous get started fast.

File Illinois Reports & Taxes

In Illinois, corporations file an annual report each year, forth with a state franchise tax. In addition, the country has a corporate internet income tax and an unusual business organization tax called a "personal property replacement taxation."

What is the Illinois Annual Report and Franchise Tax?

The Illinois Annual Written report and Franchise Tax is a combined filing you must submit each year. The first half of the form is the Almanac Report part, so it'due south fairly straightforward. You update information on directors, officers and shares. You must likewise confirm your registered agent and function (but you can't actually update this information hither—that requires a $25 fee and a Argument of Change form).

The second half of the form helps you summate your franchise revenue enhancement, which tin either be based on paid-in capital (at a rate between 0.ane% and 0.15%) or an "allocation factor," which takes into account your gross assets and revenue.

How much is the Illinois Annual Report and Franchise Tax?

A minimum of $75. The annual report has a flat fee of $75, but you'll also demand to pay however much franchise tax is owed. At that place is some good news though—the state is phasing out the franchise tax over the next few years. In the concurrently, franchise tax exemptions increase each year until the revenue enhancement goes abroad in 2024. In 2022, the first $1K is exempt. In 2022, the showtime $10K is exempt, and in 2023, the outset $100K is exempt.

When is the Illinois Annual Report and Franchise Revenue enhancement due?

The filing is due before the first solar day of your ceremony month (the month yous first incorporated). For example, if you formed your business on Apr 17th, you're required to file by March 31st.each year.

These filings can be easy to forget—which is why we send our clients automated reminders for your Illinois Almanac Written report and Franchise Tax filings. Or improve yet, permit usa file for yous. With our business renewal service, nosotros send you the completed annual report for you to add together your tax information, then submit the report for y'all for $100 plus the land fee and whatsoever tax owed.

What should I know most Illinois corporate taxes?

Besides the annual franchise tax discussed to a higher place, Illinois corporations have two more major taxes to contend with: a corporate net income revenue enhancement and a personal belongings replacement tax.

The corporate income taxation rate is a flat 7%. The personal property replacement tax (which weirdly has nil to do with holding) also taxes net income. The rate is 2.5% for standard C corporations and 1.five% for Due south corporations. Essentially, this ways a typical corporation pays a combined 9.5% rate on their net income.

The Illinois sales tax is half dozen.25%. City, county and specialty sales taxes can be tacked on also, making the average full sales tax 7.758%.

Do corporations have to register with the Illinois Department Of Acquirement?

Yep, if you lot conduct business in Illinois, you're required to register with the Illinois Department of Revenue. You lot can annals via MyTaxIllinois or by filing an Illinois Business Registration Awarding. You'll need your EIN earlier y'all tin register.

How can I submit the Illinois Manufactures of Incorporation?

You can file Illinois manufactures online or by mail. Mailed filings must be submitted in duplicate (typed or printed in black ink) to the following address:

Secretary of State

Section of Business concern Services

501 S 2d St, Rm 350

Springfield, IL 62756

How much does it cost to start an Illinois corporation?

At to the lowest degree $175. The base filing fee is $150, but the state'southward initial franchise revenue enhancement is also due upon filing. The tax is $ane.50 per $1K of paid-in capital in the state with a minimum taxation of $25. If filing online, there's likewise a "payment processor fee" of a few dollars.

Rent united states of america for a one-time fee of $405, including the state filing fees and minimum franchise taxation fee. Need it expedited? Your total price is $510 for one-twenty-four hours filing. Or, pay just $50 out the door with our VIP monthly payment option.

How long does it take to showtime an Illinois corporation?

24 hours expedited. Accept some time and desire to save a hundred bucks in extra fees? Forgo expediting and receive your approval in about x days.

If you hire Northwest to start your corporation, we file online and typically take your expedited Illinois corporation formed within 24 hours.

Does an Illinois corporation need a concern license?

There's no general, statewide business license required in Illinois, but some cities and counties have local requirements. For example, while Chicago simply licenses specific business organisation activities, Evanston requires all businesses to obtain a license and renew it each twelvemonth.

For some license applications you lot may need an EIN or a certified copy of your Articles of Incorporation. At Northwest, we tin streamline the process and get these for you—merely add on these items during checkout.

What is a strange Illinois corporation?

A corporation formed outside of Illinois—but which conducts business in the state—is considered a foreign Illinois corporation. For example, if you lot incorporated in Indiana just determine to open a storefront in Illinois, you would be a foreign Illinois corporation. This too ways you would need to register with the country by filing an Awarding for Authority with the Illinois Secretarial assistant of State. Foreign corporations are required to file the Illinois Annual Report and Franchise Tax each year as well.

Can Northwest aid me form a nonprofit corporation?

Admittedly! We're happy to start a nonprofit corporation for you. Note that incorporating an Illinois nonprofit requires a different form. The filing fee is lower likewise. Illinois nonprofits do not file the state'south franchise tax simply must file an annual report each twelvemonth ($ten).

How tin I get an Illinois phone number for my corporation?

It's a puzzler: you need a local number to brandish on your website and give to customers, just you don't desire to brand your personal number quite so…public. We get it. And we've got you lot covered with Northwest Phone Service. Nosotros can provide yous with a virtual phone number in any state—plus unlimited call forwarding and tons of easy-to-apply features. You can effort Phone Service gratis for 60 days when yous hire us to form your corporation, and maintaining service is just $nine monthly after that. No contract required.

Our Illinois incorporation service is designed to exist fast and like shooting fish in a barrel—signing up takes merely a couple minutes. Here's how it works:

1

Signup

Nosotros offer flexibility with two dissimilar options for payment. You tin can pay everything up front, which includes a full twelvemonth of registered agent service. Or, pay just $50 out the door with our VIP monthly payment option. With our VIP option, we also include an EIN. Merely choose one of the buttons below, respond a few easy questions about your business and submit your payment.

2

State Approval

Side by side, we'll prepare and submit your Illinois Articles of Incorporation to the Secretarial assistant of State, Department of Business Services. In the meantime, you'll have immediate admission to your online business relationship, where you tin can find useful state forms, pre-populated with your business information.

three

Your Illinois Corporation!

Once the Illinois Section of Business Services has approved your filing, nosotros notify you that your Illinois corporation has been legally formed. You tin can now move on to adjacent steps, like holding your organizational meeting and opening a bank account.

How To Set Up A Corporation In Illinois,

Source: https://www.northwestregisteredagent.com/corporation/illinois

Posted by: schmidtcagoo1983.blogspot.com

0 Response to "How To Set Up A Corporation In Illinois"

Post a Comment